how are rsus taxed at ipo

Any sale gains are taxed using short or longer-term capital gains rates determined by the shares holding period. Your company has its IPO.

What Happens To Firm S Cash Debt And Equity After Ipo Failure Quora

RSUs can trigger capital gains tax but only if the stock holder chooses to not sell the stock and it increases in value before the stock holder sells it in the future.

. All your vested RSUs will be granted on the day of IPO so you will have only 1 vesting event. In contrast two types of stock options exist and are taxed differently from one another. With double-trigger RSUs you will face compensation income when all the vested shares are delivered in one batch at the specified time after the second trigger and then also the FICA taxes when the IPO occurs.

With RSUs if 300 shares vest at 10 a share selling yields 3000. But Im pretty sure I havent been taxes on RSUs Ive received from a pre-IPO company so I suspect its not always when the shares are delivered. Now companies do usually withhold the statutory 22 tax rate usually by withholding shares from your total RSU grant.

Incentive stock options ISOs. Your company should withhold a portion of your RSUs at the time of IPO which will. The first is the tax shrink that you will experience from the number of shares you are promised to the number of shares that you get.

If a company is already public RSUs are usually taxable when they vest. Depending on your tax bracket the flat federal withholding rate on stock compensation may not be enough to cover the total tax you really owe on the value of the shares you receive. You are granted some RSUs.

The fair market value of RSUs is taxable as ordinary income on the date that shares are actually transferred to the employee. The amount of income to report for each taxable year is the number of shares that have vested multiplied by the market value of each share on the day they vest. RSUs act like an IOU for future stock removing the need for a 409a and creating immediate buy-in privilege for team members without forcing them to pay in advance.

However you will need to input your best guess in terms of what the stock price will be at a future vesting event. For estimating future taxes. RSUs at IPO - Potential Risks and Pitfalls to Look Out For IPO Pitfall 1 - Taxes Withholding Preferences.

The two types of stock options and taxation guidelines are as follows. Are they double trigger vestliquidity event 83i or do employees have to pay taxes in cash as soon as they vest. So if you had 10000 RSUs youd actually receive only 7800.

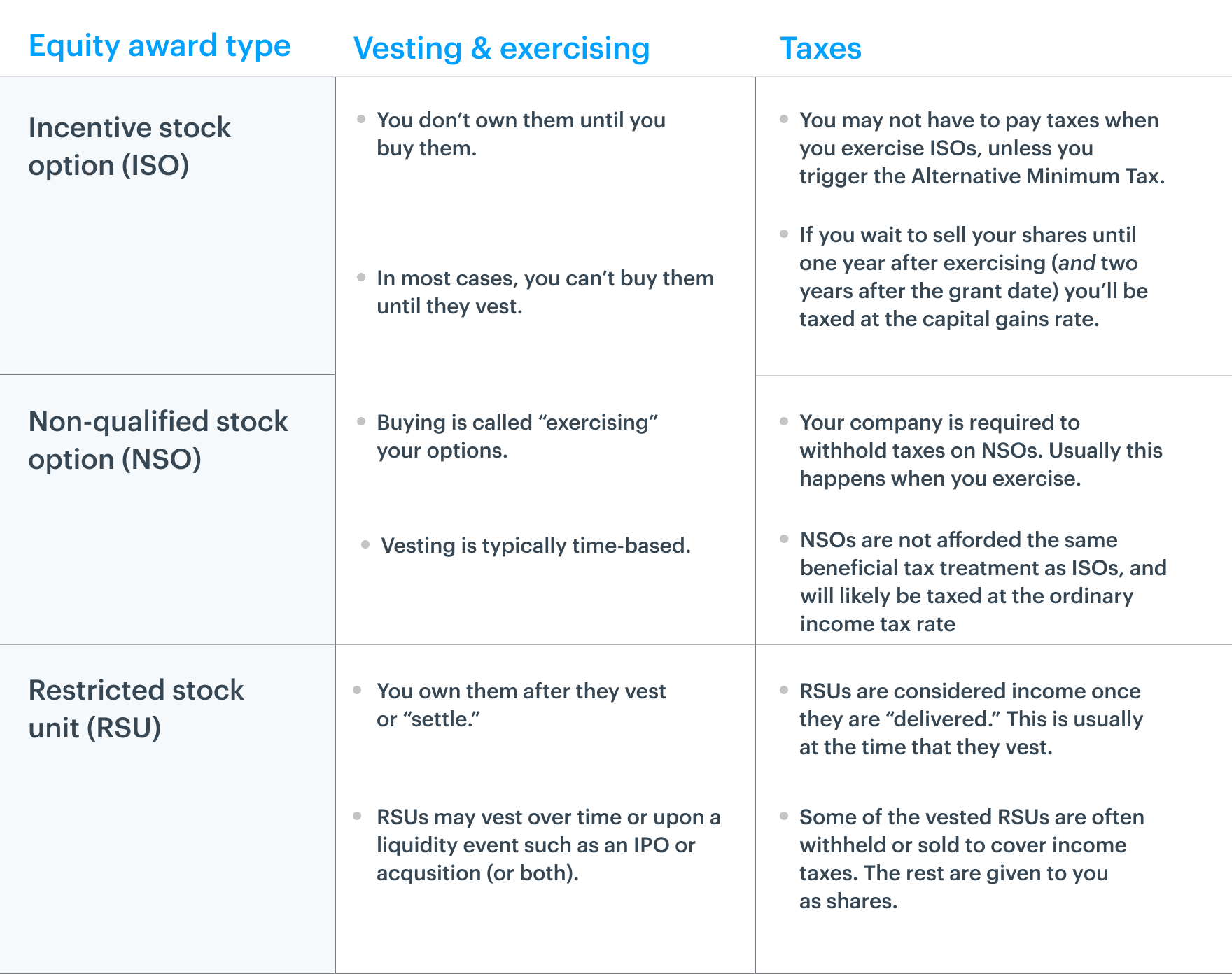

How are RSUs taxed. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. Once they vest they get taxed and they are in your possession.

RSUs are taxed at ordinary income rates when issued typically after vesting. RSUs are included in wage income. In examples like Airbnb Doordash etc.

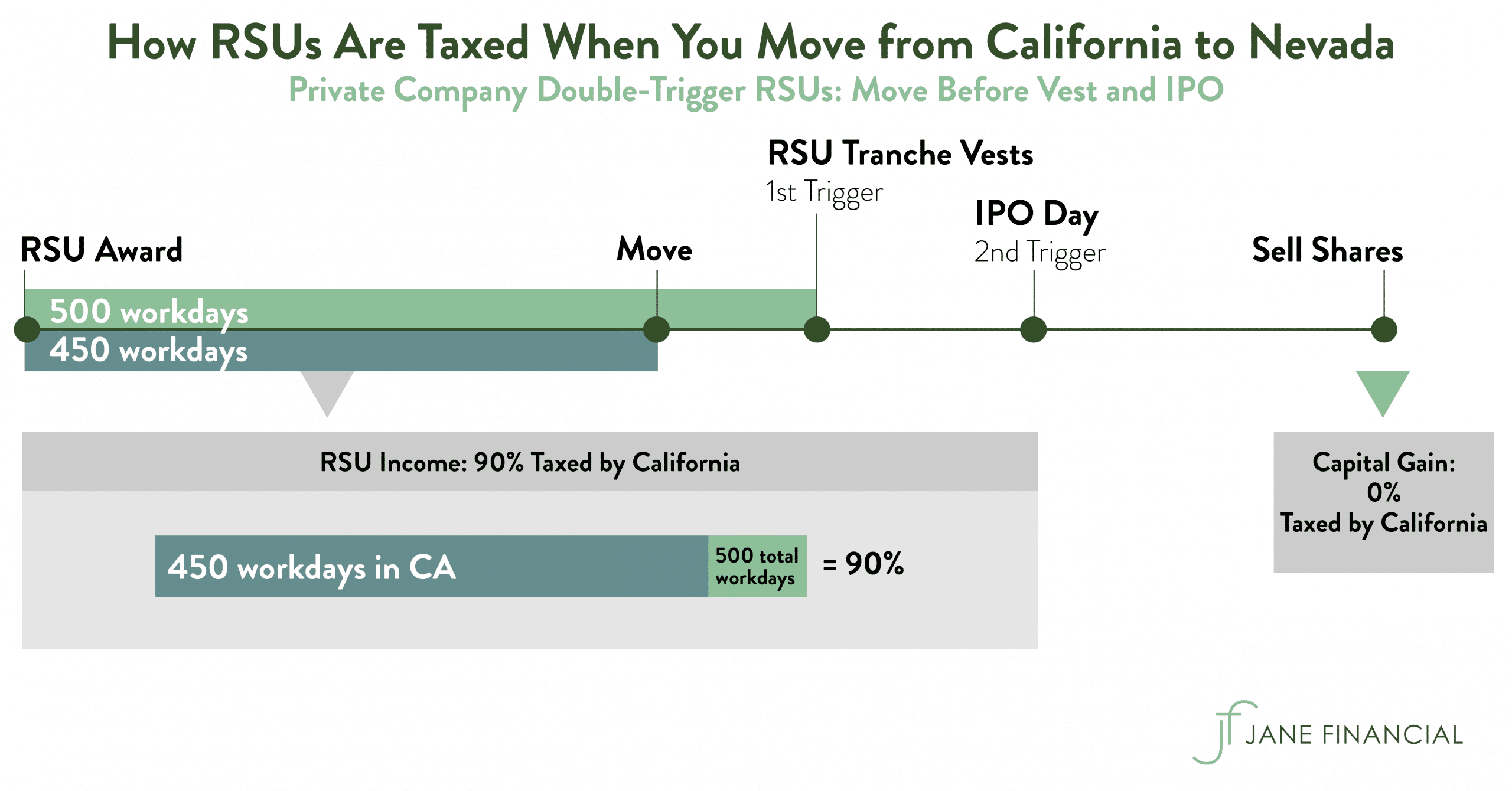

Even if the share price drops to 5 a share you could still make 1500. How do employees handle income taxes on pre-ipo vested rsus. If RSUs vest while youre at a private company they usually wont be taxed until your company goes public.

Yet all the RSUs are released fully on that day and you owe taxes. Once shares vest they are yours to keep. With RSUs there are no decisions to be made except for when you sell them.

Gains on RSU stocks are taxed at the capital gains tax rate. FICA taxes and all. You can also use this calculator to estimate your total taxes for the year.

In other words if the stock increase in value after youve paid ordinary income tax on it and you sell it in the future at a. For estimating taxes for IPOs. When RSUs are issued to an employee or executive they are subject to ordinary income tax.

RSUs are taxable with taxes withheld similarly to wages as of the date the RSU vests and the actual stock is transferred to you. When shares are sold the difference in value is treated as capital gain or loss. The most affordable equity management system available.

As each of your RSU tranches vest they become ordinary taxable income. Your RSUs vest and become taxable 180 days after Event 2. We spent years working with legal experts from top.

Input all the shares vested and the IPO price in the boxes below. Upstock makes RSUs accessible for all companies at any stage. Since RSUs are taxed upon transfer of shares to the participant this is commonly at vest.

RSUs can be frustrating for a couple of reasons. Whether you work for a large established company or a startup on the verge of an IPO RSUs ISOs and the differences between. Capital gains tax only applies if the recipient of RSUs does not sell the stock immediately and it appreciates in value before it is sold.

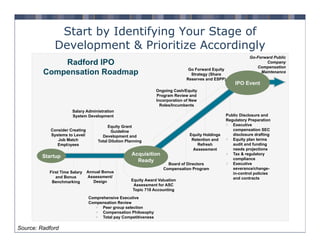

RSUs at private companies usually have a vesting schedule that has a double trigger. How are RSUs taxed. As the private company matures and moves toward an IPO or acquisition equity grants tend to shift toward restricted stock.

Since RSUs are taxed upon transfer of shares to the participant this is commonly at vest. Your company has its IPO. If your company grants you RSUs the total amount vested at the time of IPO is classified as supplemental income and is taxed at the regular income tax bracket rate.

However in the case where the company requires or a participant elects a deferred distribution where shares are not delivered until a later date only FICAFUTA are due at vest and income tax is calculated and due based on the share price on the distribution date.

Avoiding The 1 Million Tax Trap New Section 162 M Regulations Affect Use Of Rsus By Ipo Companies Compensia

How Many Stock Options Rsus Do Did Established Startups 6 7 Years Old Offer To New Hires Pre Ipo 1 2 Years From Ipo Quora

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

How Equity Holding Employees Can Prepare For An Ipo Carta

What You Need To Know About Restricted Stock Units Rsus

Restricted Stock Units Jane Financial

Ipo Impact On Equity Grants Of Private Equity Portfolio Companies Jamieson

Year End Planning For Employees With Post Ipo Losses Schmidt

Equity Compensation End To End Strategies For Private Companies

Restricted Stock Units Jane Financial

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Financial Planning For Employees Before And After Ipo

Restricted Stock Units Jane Financial

Rsus And Your Company S Ipo Taxes And Other Considerations

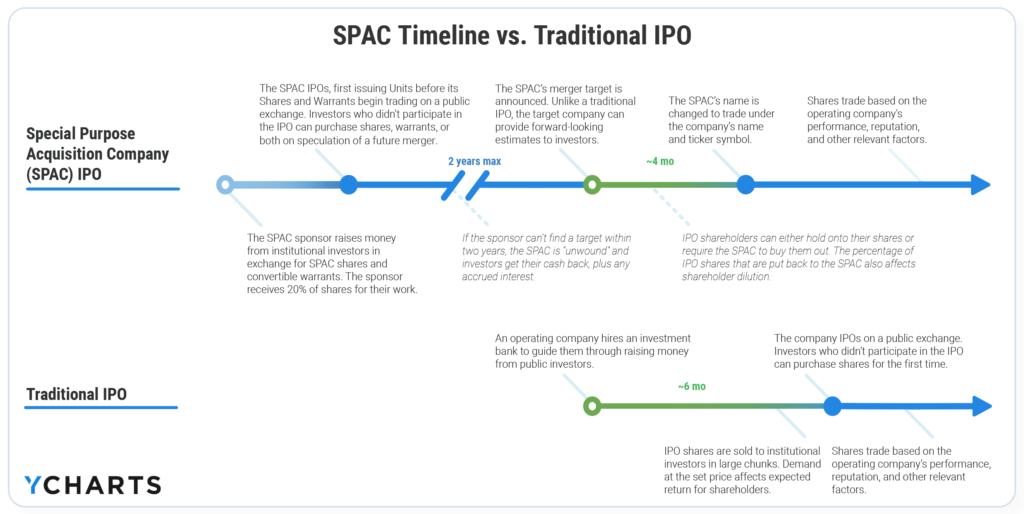

What Happens To Stock Options In A Spac Merger

Tech Company Employees With Lots Of Pre Ipo Stock Might Be Wondering About Hedging As A Strategy Hedges Stock Options Option Strategies